People’s lives do not revolve around banking. DBS’ strategy is built on the cornerstone of a customer-centric digital platform which goes beyond banking by focusing on the customer’s lifestyle, their evolving needs and eliminating wasted customer time.

DBS seeks to provide a personalized experience for each individual customer by addressing all relevant touch points. We want to create an unsurpassed customer journey that allows customers to “Live More, Bank Less”.

As part of our constant transformation, we have embarked on a journey to achieve n=1 personalisation, achieved through the following:

The objective is to offer personalization, create unique customer experience and shorten the time users take to perform a certain task. It helps to increase app visibility, optimise user acquisition and increase card usage. Through our Data Analytic studies, we identified these customers’ needs:

DBS has shifted in thinking, from the product-centric ways of traditional banks — selling a mortgage or a credit card — to seeing from the customer’s point of view. (‘Features’ image)

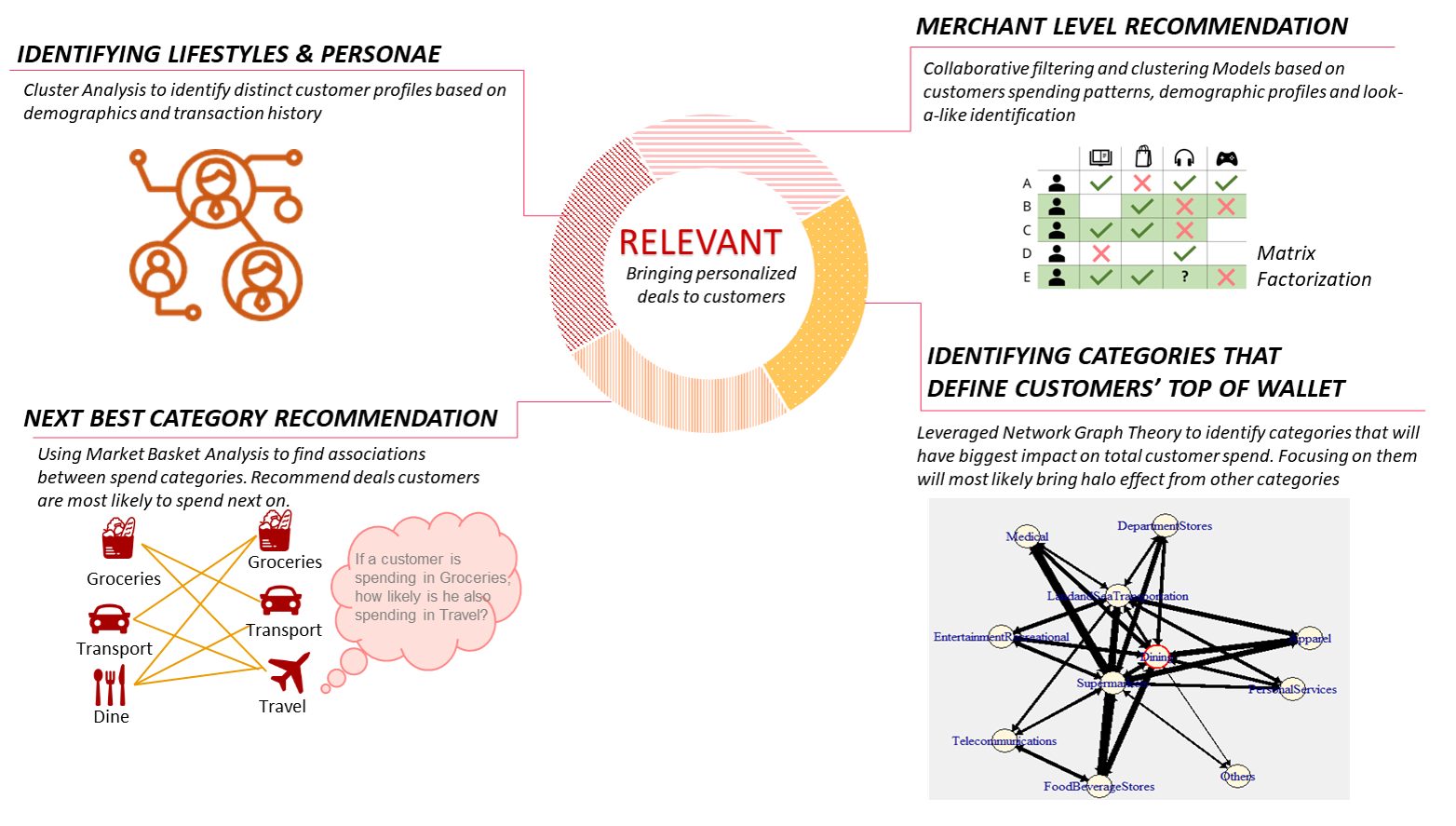

We developed the following solutions to address customers’ needs and create better personalized customer experience & journey.

Better Customer Experience and Engagement

DBS has rolled out contextual engagement campaigns to better customer experience, activate MCC extension and drive spend lift. The engagement campaigns were specially curated based on customer spending pattern and demographics. (‘Contextual Campaign’ image)

DBS has also launched over 30 Personalised Campaigns in 2019 which includes Lunar New Year, Groceries, POSB Everyday Refreshed, Spend & Win and more. It provides customers with a seamless experience and eliminating common pain points. Here are some top improvement areas:

DBS also capitalized on customer spend propensity data and contextually engage them via ATL & BTL communications such as DBS/POSB website, eDM & App-Push Notification, Digital channels – Facebook/Instagram/Google, TheSmartLocal.com video/editorial, Golden Village media channels.

The integration of multiple channels allows customers to access the same offers via the DBS website and DBS Lifestyle App. Customers are not restricted to only registering for campaigns via DBS Lifestyle App. They can register via DBS website with their Digibank login credential. Upon successful registration, customers will be encouraged to download DBS Lifestyle App to continue to track their spend.

What separates DBS Lifestyle App from the competition, is its ability to provide a personalized experience for each individual customer throughout the entire customer journey (from how they receive the information, perform cards services, redeem their rewards and receive instant prizes). Our engagement framework utilizes machine learning models to identify various opportunity areas.

We engage customers contextually by leveraging on a unique algorithm (collaborative filtering + lookalike model) to cull leads by spend propensity. This has helped to achieve business goals to identify new potential customers that share similar spending patterns with customer of a specific segment which gives us massive improvement in customer engagement.

Measurable results for the bank

Comparing Lunar New Year campaigns for 2018 and 2019, we saw higher engagement, spend activations and spend lift.

Summary