Aside from driving revenues and increasing our customer base, the premise for the development of the Keystone Mobile Banking App was to support the national drive towards a cashless economy as well as to foster financial inclusion among Nigeria's un-banked population. A 2012 survey on Nigeria showed that 34.9 million adults representing 39.7% of the adult population were financially excluded. Only 28.6 million adults were banked, representing 32.5% of the adult population.

However Nigeria has one of the largest population of mobile phone users in Africa. This provided an opportunity to build on the high mobile device usage as a means to drive the secondary objectives.

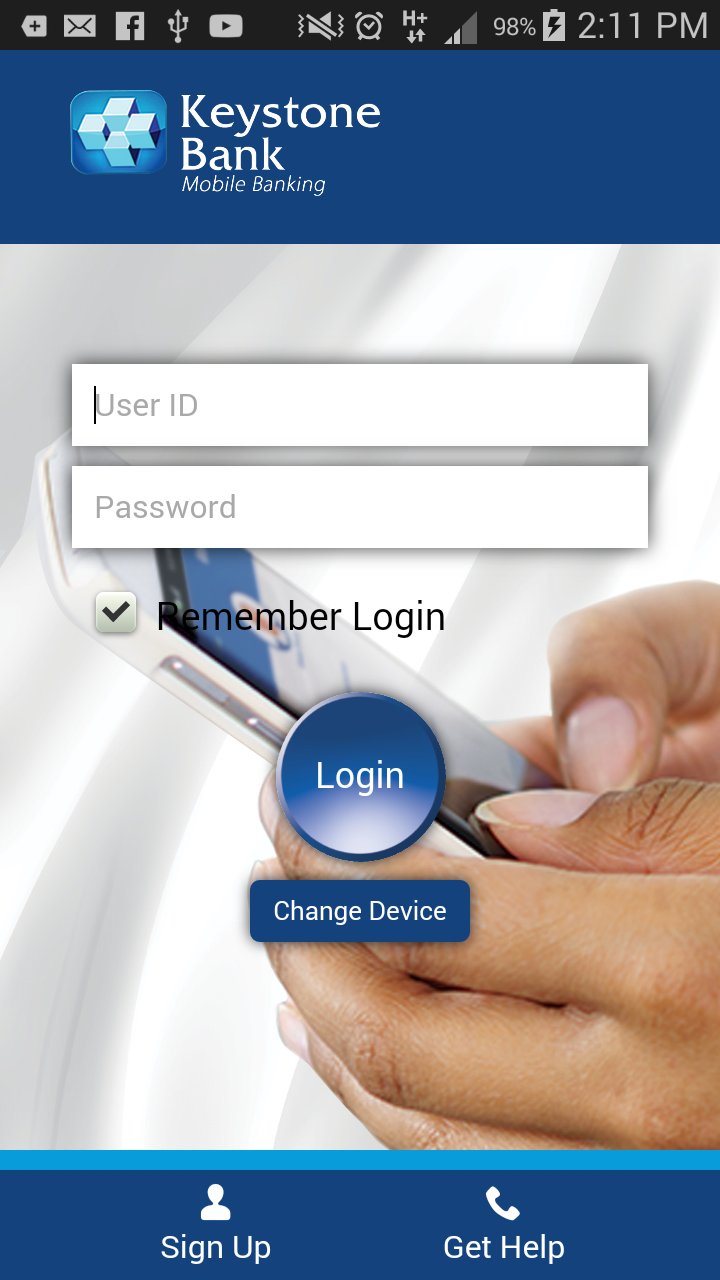

The approach was to reduce the barrier for entry for new and existing customers. A comprehensive campaign was carried out to create awareness about the App and the Ease of use. The App provided customers with access to their savings, current and business accounts.

Following the awareness campaign for the app, the bank saw Keystone bank achieving 10,000 downloads within the first 30 days from the launch. Secondary achievements included an increase in account opening by new customers