DBS PayLah! – More than a digital wallet

With over 1.8 million users, DBS PayLah! is one of DBS’ signature offerings, and since its launch in 2014, PayLah! has enabled DBS to radically transform Singapore’s payments landscape. Making everyday banking accessible for everyone requires a rethink in lowering the barrier of entry for the next generation of digital payment users, and this is where PayLah! For Teens comes in.

To enhance PayLah's value proposition as the go-to app for our customers' everyday lifestyle needs, DBS integrated the functionalities of its DBS Lifestyle app into DBS PayLah! in October 2020, to enable DBS customers to enjoy personalised credit and debit cards deals and rewards, and conduct even more everyday transactions on one unified app. This integration creates a seamless user experience and bring more convenience to customers.

Our objective is to provide personalization, create a unique customer experience and shorten the time users take to perform a certain tasks. With DBS PayLah!, we aim to:

Democratising digital banking towards Smart Nation agenda

Students are brought up in a digitally native environment but are constrained by limitations for bank account opening. Recognising this, we focused on addressing the needs of students under 16 years old who might want to open and use a PayLah! account. Identifying a gap in the market wherein teens are not able to partake in the digital payments’ ecosystem, our goal with PayLah! for teens was to enable parents to have an efficient way to help their children achieve digital payment readiness.

Helping students become empowered and financially savvy adults

Based on our immersion findings, parents want to inculcate the values of financial independence to their children so that they can be responsible for their own money someday. PayLah! for Teens enables parents to have a conversation with their children about managing their expenses, as well as impart simple financial literacy and budgeting skills.

Teens on the other hand can enjoy the benefits of going cashless and making simple digital transactions to kick start their journey to financial independence.

Ecosystem Partners on PayLah!

For DBS PayLah! growing our ecosystem partnerships is a key pillar of our overall strategy. By bringing on board a growing selection of partners and expanding our acceptance network, we offer our users unparalleled convenience in being able to access and pay for a wide selection of everyday services on the platform. DBS PayLah! users today can buy travel insurance, book movie tickets, order food delivery, pay bills and transport expenses, browse entertainment and dining offers, make fund transfers and scan to pay for their purchases at more than 180,000 merchants in Singapore. Please see visuals Screen 1 and Screen 2 for an overview.

Providing a personalized experience for each individual customer by addressing relevant touch points

DBS PayLah! has enabled DBS to build a deeper relationship with our customers. It has helped us create a strong proposition to differentiate ourselves from other similar apps in the industry by providing a personalised experience for each individual customer throughout the entire customer journey. Some of these functionalities include:

Personalised Card Deals (see attached carddeals.jpg for an example): The app recommends exclusive offers and promotions to customers based on their locations/proximity, past spending history and so on. Advanced Machine Learning models have been implemented to ensure hypersonalisation for the customer, taking into account the customers' preferences based on past interactions and expenditure with the bank.

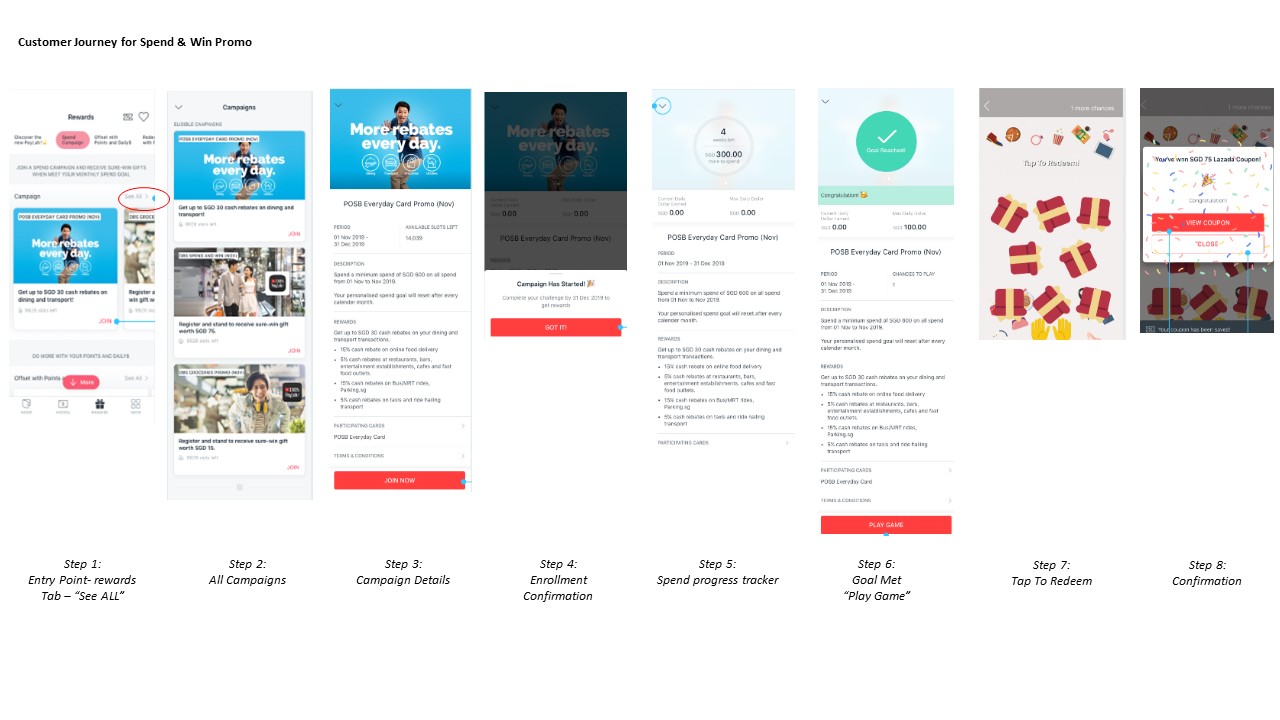

Personalised Spend Tracker (see attached spend&winpromo.jpg for an example): Spend & win promotions are tailored based on customers' past spend behaviour and spend goals are personalized. This feature is developed to help eliminate several pain points of participating in bank promotions – customers can now check how many registration spots are left, join promotions curated especially for them, track their spend progress and be rewarded with prizes instantly when they meet their goals.

Instant Rewards Redemption (see attached offsetspend.jpg for an example): Customers use their DBS points to offset their recent purchases instantly, anywhere, anytime.