With over 1.8 million users, DBS PayLah! is one of DBS’ signature offerings, and since its launch in 2014, PayLah! has enabled DBS to radically transform Singapore’s payments landscape. Today with a preponderance of apps, consumers need to go through the cumbersome effort of having to download & register for an app to fulfill various lifestyle and banking needs. To address this, we launched partner tiles on DBS PayLah! to integrate varied services relevant to customers within one convenient super app. Now, from within their PayLah! app, users can buy travel insurance, book movie tickets, order food delivery, pay bills and transport expenses, browse entertainment and dining offers, make fund transfers and scan to pay for their purchases at more than 180,000 merchants across Singapore.

In line with our vision to help customers ‘Live More, Bank Less”, we integrated the functionalities of our DBS Lifestyle app into DBS PayLah! in October 2020, to enable more than 3.3 million cardholders to enjoy personalised credit and debit cards services and conduct personalised contextualised lifestyle offerings, as well as manage more everyday transactional needs seamlessly all within one app. These offerings, enabled by the bank’s technology and intelligent banking capabilities, provide our consumers with both unparalleled convenience and empowerment to make the best choices for their lives.

The following features were built as functionalities to address customers’ needs, create an improved customer experience and help improve productivity:

Partner Tiles: In 2020 we on boarded several key ecosystem partners on to PayLah! as partner tiles on the DBS PayLah! homepage. This feature allows our users to access & complete various services e.g. ordering a taxi, paying taxes & bills, ordering food delivery seamlessly within PayLah! without having to download or register for any additional apps (see attached image Taxi 1 for an exemplar). In addition to these, in response to the Covid-19 pandemic, we partnered with Temasek Foundation on its “Stay Prepared StayMasked” initiative which allowed consumers to get all details on where and how they could collect their complimentary masks as well as order and pay for additional face masks via PayLah!. With partner tiles our users no longer need to go through the effort of downloading multiple apps as they can enjoy the convenience of having various services within reach via one app.

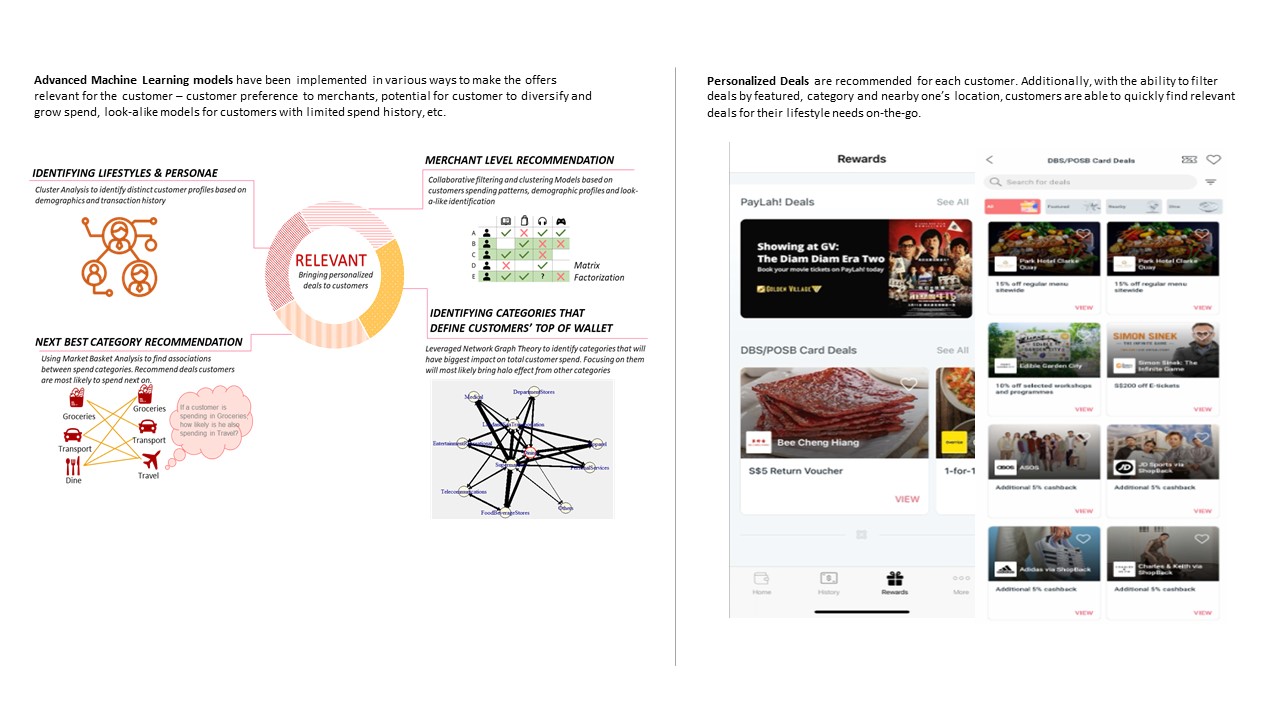

Personalised Card Deals (see attached carddeals.jpg for exemplar): The app recommends personalised and exclusive offers to customers based on their locations/proximity, past spending history, etc. Advanced Machine Learning models have been implemented to make the offers relevant for the customer, taking into consideration their merchant preferences and so on. With this feature, customers no longer need to spend time searching through a plethora of card deals to find the ones most relevant to them.

Personalised Spend Tracker (see attached spend&winpromo.jpg for exemplar): Spend & win promotions are tailored based on customers past spend behavior and the spend goals are personalized. With this feature, it provides greater transparency and elimination of several pain points of participating in bank promotions. Customers can now check how many registration slots are left, join promotions curated especially for them, receive only relevant messages, track their spend progress and be rewarded with prizes instantly when they meet their goals.

Instant Rewards Redemption (see attached offsetspend.jpg for exemplar): This feature enables flexibility and convenience for customers to use their DBS points to offset recent purchases instantly, anywhere, anytime. Previously, customers were limited to redeeming items off the rewards catalogue. Now, they can use their DBS rewards points to redeem for virtually any of their past purchases.

Apps are now an integral part of our daily micro-moments and the DBS PayLah! app has enabled DBS to build a deeper relationship with our customers. It has helped us create a strong proposition to differentiate ourselves from other similar apps in the industry by providing a personalised experience for each individual customer throughout the entire customer journey.

DBS continues to see high adoption and usage of its digital banking services since the onset of Covid-19, as Singaporeans are not only shifting to, but also sticking with, their mobile phones and online platforms for everyday payment and banking needs.